📑 Table of Contents

SMS has become a vital channel for the financial sector. Banks need to communicate quickly, clearly, and securely. With SMS technology, they reach customers in real-time, regardless of location. Unlike email, text messages have a 98% open rate. Most are read within minutes.

Speed and simplicity make SMS a powerful tool. From security alerts to loan offers, banks use it to drive engagement and trust. Moreover, text messaging helps banks lower operational costs and reduce dependency on call centers.

In a digital-first world, SMS gives banks a competitive edge. It keeps customers informed and connected while reinforcing brand reliability.

Fraud Alerts and Security Notifications

Security is the top priority in banking. With SMS technology, banks instantly alert customers to suspicious activity. If a transaction looks unusual, a text goes out right away. Customers can confirm or flag the transaction. This real-time interaction helps prevent fraud.

For example: “Unusual activity detected on your card ending in 4321. Did you make this purchase at Store XYZ? Reply YES or NO.”

SMS is also used for two-factor authentication. Before logging into an account or making a high-value transaction, users receive a code via text. It adds a critical layer of protection.

Banks are also integrating biometrics with SMS to increase security. Some use it to deliver one-time passwords (OTPs) that expire quickly, adding a dynamic safeguard.

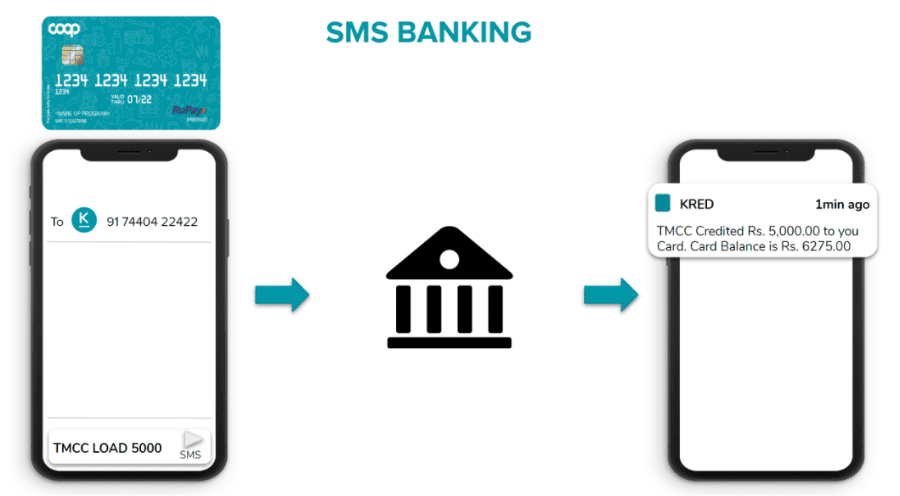

Account Updates and Transactional Messages

Banks use SMS to keep clients informed. Account balance updates, transaction summaries, and payment confirmations go straight to the phone. These texts reduce confusion and build confidence.

Examples include:

- “Deposit alert: $2,500 credited to your account.”

- “Your mortgage payment of $1,200 was received. Thank you.”

Customers don’t need to log in or call. A simple message provides clarity and peace of mind. These updates also help with budget tracking and financial planning.

Loan and Credit Notifications

From loan pre-approvals to credit card promotions, SMS technology enables targeted offers. Banks can segment lists by customer type or account activity. As a result, customers receive relevant messages that fit their financial needs.

For example, “You’re pre-approved for a personal loan up to €15,000. Reply YES to learn more.”

This approach feels personal and direct. It also shortens the decision-making process. Furthermore, time-sensitive campaigns via SMS can generate faster responses compared to email.

Appointment and Reminder Texts

Whether it’s a mortgage consultation or branch meeting, banks use SMS to reduce no-shows. Reminders keep customers informed and prompt action. A quick “Your appointment is tomorrow at 2 PM. Reply C to confirm.” goes a long way.

Text reminders help reduce staffing inefficiencies caused by missed meetings. They also let customers reschedule easily by replying or tapping a link.

Banks now use SMS for virtual appointment links as well. A follow-up might say: “Join your video meeting with our advisor at 2 PM: [secure link]”

Customer Support and Feedback

SMS opens the door for two-way communication. Clients can text in with questions, and support teams respond instantly. This method is less intrusive than calls and quicker than email.

Banks also use SMS surveys after a visit or transaction. Feedback helps improve service quality and customer satisfaction. For example: “Rate your recent visit to ABC Bank branch. Reply with a number from 1 to 5.”

Some banks integrate chatbots that answer FAQs via SMS, offering 24/7 support without increasing headcount.

Regulatory and Compliance Updates

Banking regulations change frequently. SMS allows banks to notify customers about updated policies, privacy agreements, or terms. These short messages link to more detailed content online.

For instance: “We’ve updated our privacy policy. Read the changes here: [link]”

This ensures clients stay informed and compliant with industry standards. It also reduces customer service inquiries about terms and agreements.

Marketing and Cross-Selling Opportunities

While security and service remain primary uses, SMS is also effective for marketing. Banks use SMS to:

- Promote new financial products

- Announce branch openings or relocations

- Share seasonal tips or financial literacy resources

With proper consent, banks can tailor promotions based on customer behavior. For example, “Boost your savings! Open a high-yield account today with 2.5% interest. Click to apply.”

These campaigns, when done thoughtfully, drive engagement without feeling spammy.

Benefits of SMS in Banking

- Real-time delivery and response

- Higher engagement rates

- Increased trust and transparency

- Better fraud prevention

- Reduced support volume via self-service options

- Greater personalization

- Improved customer retention

- Lower operational costs

Final Thoughts

SMS technology empowers banks to deliver faster, smarter service. From alerts to offers, it enhances both security and experience. It creates a two-way relationship between banks and customers—efficient, personal, and scalable.

As banking continues to evolve, SMS remains a simple yet powerful bridge. It supports digital transformation without complicating customer experience.

Now is the time for banks to invest in SMS strategies that connect, protect, and retain customers in a mobile-first world. Whether it’s fraud alerts or financial advice, the right message at the right time makes all the difference.